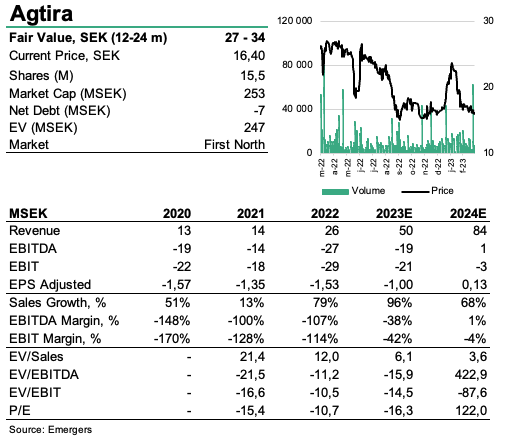

In line with its ambitious growth plan, Agtira is now expanding its engagement with grocery producer and distributor Greenfood in a SEK 285m cucumber offtake deal, contingent on Greenfood signing resale deals for 80% of the volume produced in the first five years. With the rising importance of food tech and the company’s strong momentum from 2022 carrying over into 2023, we expect a continued positive news flow and maintain our fair value range at SEK 27-34 per share, in 12-24 months.

Andreas Eriksson | 2023-04-11 10:00

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

Increasing production by 65% with new Greenfood deal

The LOI signed with Greenfood in 2022 covered up to 10 Greens systems, of which two have now started to take shape. One Greens system will be constructed in connection to ICA Maxi Haninge, whereas the recently announced cucumber deal refers to a system using excess heat from a server hall in Boden, which should strengthen the environmental profile even further. The larger size of the Greens-system in Boden will also mean an increase of Agtira’s production capacity by 65%.

While we still miss some of the pieces to fully incorporate this into our model, such as location and permits that have yet to be sorted out, we are encouraged by the forward movement from LOI towards establishing systems. The deal confirms Agtira’s Farming-as-a-Service business model as an attractive setup for major grocery companies.

The growing importance of food tech

Food tech continues to rise on the agenda world-wide, as evidenced by a recent article by the BBC which talks about the many benefits of urban farming, what crops can be grown and also raises the question if we could even shift to completely soil-free farming someday. Today however, the only commercially viable options using this technique, are high value crops that grows quickly, such as leafy salads, smaller vegetables and fruits like tomatoes and strawberries.

With a continued supportive macro backdrop in favour of smarter agricultural solutions, food tech companies offering solutions for a more streamlined farming, like Agtira, stand to benefit. Offering a complete farming system that reduces the area needed, requires no pesticides and 95% less water, Agtira clearly has a place in the farming of the future.

Positive news flow to drive revaluation

In our valuation approach we have assumed a fixed contribution per InStore, Greens and Complete system, based on a pre-decided size and production capacity. But as the systems built under the Greenfood offtake deal will vary in size, we now find a higher degree of uncertainty in our forecast of 17 systems installed by 2024 translating to recurring revenues of SEK 84m.

We now await more information about the Greenfood systems and maintain our fair value range intact at SEK 27-34 per share in 12-24 months, with a continuous positive news flow and new deals signed as important catalysts. Other news to look for is progress on the ICA/Greenfood Greens system being built in Haninge, as well as a more viable financing model to support a high momentum in the rollout, which remains one of the company’s most important bottlenecks.

DISCLAIMER