With its third attempt to scale offline payments in India, Crunchfish hopes that its new Offline Terminal Infrastructure (OTI) will mark a turning point. With the OTI, the company addresses the ecosystem-wide barriers that stalled its previous attempts, this time with a model directly aligned with India’s payment architecture. Following a revision of our rNPV model, we now find support for an rNPV of SEK 2.3 (1.7) per share, while noting that this remains based on very crude assumptions, detailed on page 2 of this report.

Johan Widmark | 2025-05-26 08:00

Rethinking the approach: from wallets to infrastructure

Crunchfish’s first two attempts (pilots with banks in 2023 and a top-down push for wallet adoption via NPCI in 2024), highlighted a key structural flaw: offline payments cannot scale without ecosystem-level buy-in. Now the company’s third iteration flips the model. By introducing a modular, interoperable Offline Terminal Infrastructure (OTI), Crunchfish embeds offline payment reception directly into existing rails like UPI and the Digital Rupee. Banks and TPAPs remain free to innovate with their own offline wallets, ensuring decentralised control while maintaining interoperability. It’s a cleaner architecture and crucially, one aligned with how card infrastructure scaled globally.

An EMVCo blueprint for CBDCs and beyond

The OTI draws explicit parallels to EMVCo’s card terminal infrastructure: a standardised, network-level backbone for reception, paired with competitive freedom for issuers. By mirroring this proven model, Crunchfish’s architecture balances the RBI/NPCI’s control over specifications with room for bank-led wallet innovation. OTI provides the missing piece, scalable infrastructure, which could unlock commercial deals not just in India, but also with global CBDC initiatives such as the Digital Euro, where Crunchfish already plays a role in conditional payment pilots. Additionally, Crunchfish has received a Decision to Grant from the European Patent Office for its initial Digital Cash patent, covering core aspects of offline payments using the Reserve, Pay, and Settle model. This follows the earlier US grant and strengthens Crunchfish’s strategic position in the growing field of offline payments, including potential use in the Digital Euro.

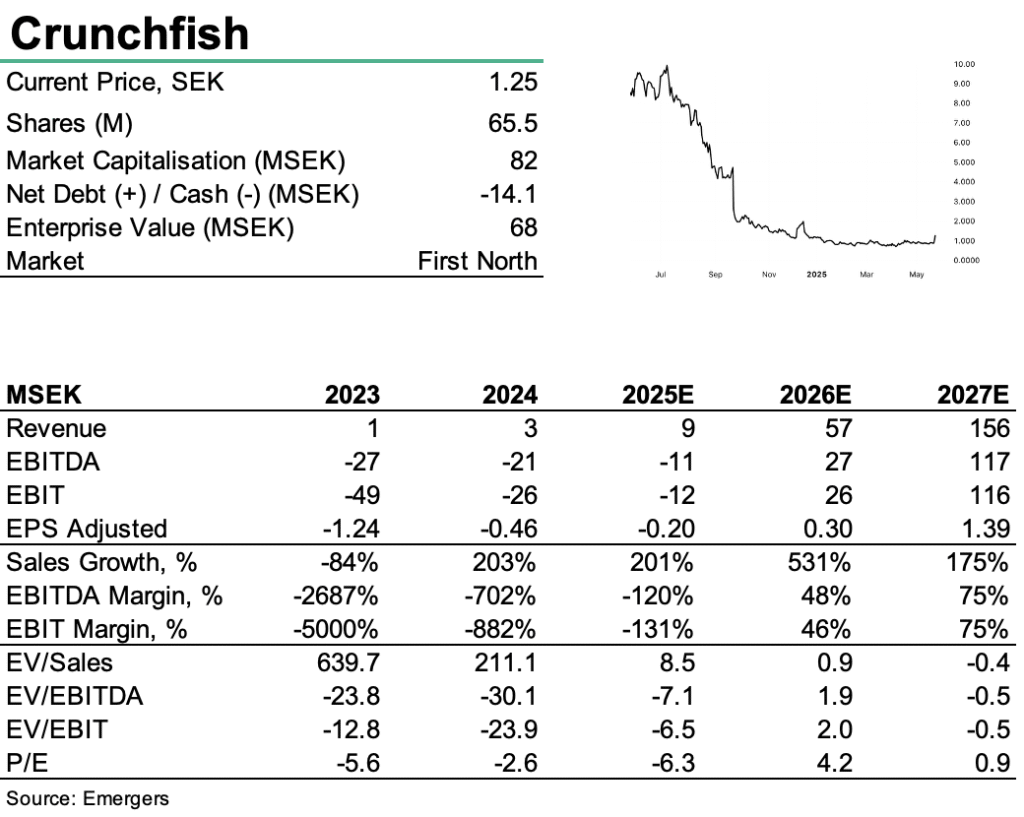

Support for an rNPV of SEK 2.3 (1.7) per share

Cash at the end of Q1’25 amounted to SEK 14m, including SEK 5.2m from the exercise of TO10. This is below the expected OPEX for 2025 of SEK -30m, although TO11, closing on May 30, could provide an additional SEK 5.6m. Absent a commercial deal with a significant upfront payment during the course of 2025, we anticipate that further funding will be needed toward year-end before the long-term potential has a chance to materialise in the P&L. We have now made several adjustments to our model, estimating 11 PSPs and 160m upfront paid users by 2028 and a value capture tapering off to reflect scale-driven pricing pressure. Using a 24% discount rate, 5% terminal growth, and 25% success probability, including also a rights issue (at 30% discount if a new deal is closed, at 50% discount if no deal is closed before then) this supports an rNPV around SEK 2.3 (1.7) per share, though we emphasise that this remains based on very crude assumptions, most of the detailed on page 2 in the report. While the case still carries some characteristics of an out-of-the-money option, we also see an interesting opportunity in the possibility that the new OTI approach could act as a catalyst for commercial discussions and a path toward a viable long-term business model.

See intevew with CEO Joachim Samuelsson here (in swedish)

DISCLAIMER