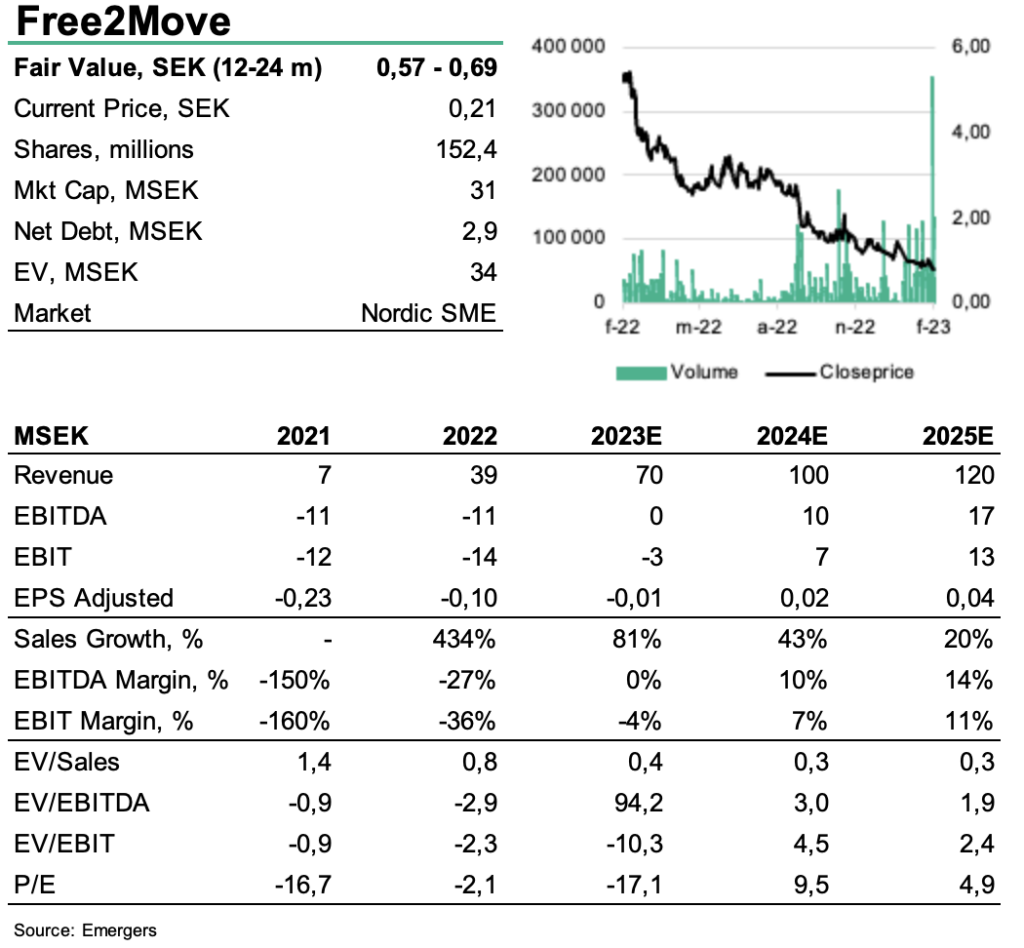

With a comprehensive offering to drastically improve the operating net for property owners, Free2Move looks to continue its strong growth momentum both organically and through acquisitions while reaching positive EBITDA this year. The order book at SEK 40m stands in stark contrast to the SEK 30m Pre-Money Market Cap and bolsters our SEK 100m revenue forecast for 2024. Adjusted for the upcoming rights issue of SEK 21m to enable additional acquisitions and to develop the offering further, target multiples of 2x Sales’24 and 12x EBITDA’24 support a fair value range of SEK 0.57-0.69 per share in 12-24 months, with further upside towards SEK 1.9-2.1 on a 3-5 year horizon.

Andreas Eriksson | 2023-02-21 08:00

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

Soaring energy prices forcing change

The continued Russian cut off from the Europe continues to affect the energy market and the higher energy prices are taking their toll on both companies and communities. Along with public incentives this has motivated property owners to accelerate energy efficiency efforts, as inaction has become too costly. Free2Move’s offering with the 2Connect SaaS-platform, enables for property owners to control and get a better overview of the property’s temperature, humidity, carbon dioxide and air quality. Adding solar panels and ventilation systems through recent acquisitions. Solortus and Sydvent, Free2Move has a comprehensive offering for property owners looking to save both money and reduce climate footprint.Cross synergies to drive organic growth

Based in Sweden, with business also in Norway, Free2Move is looking to grow both organically, driven by sales synergies between subsidiaries, as well as by acquisitions. Recent additions Solortus and Sydvent, has shown growth of about 100% respectively since included in the Free2Move group, in 18 and 6 months respectively, while the 2Connect platform provides recurring revenues with a high stickyness. In 2022, the company managed to save over 21 milion kWh for its clients, corresponding to some SEK 47m, and establish the company on the rapidly growing PropTech-market. With the costly implementation of their acquisitions behind them and a significant underlying market growth, 2023 could mark the beginning of a profitable growth journey.Sales of SEK 70m with positive EBITDA already in 2023

As the group has managed to grow sales from SEK 7.2m in 2021, to SEK 38m in 2022, we expect a continued strong growth through 2023 and 2024, reaching sales of SEK 70m and 100m respectively. Strengthened by an upcoming rights issue of SEK 21.3m to continue to develop the offering, enable additional acquisitions to either broaden or complement the existing offering, and provide the financial muscles to improve purchasing routines (lowering the unit price of solar panels), adds up to a favourable view on the outlook for Free2Move. Adjusted for the upcoming rights issue of SEK 21.3m, target multiples of 2x Sales’24 and 12x EBITDA’24 support a fair value range of SEK 0.57-0.69 per share in 12-24 months, with further upside towards 1.9-2.1 on a 3-5 year horizon.

DISCLAIMER