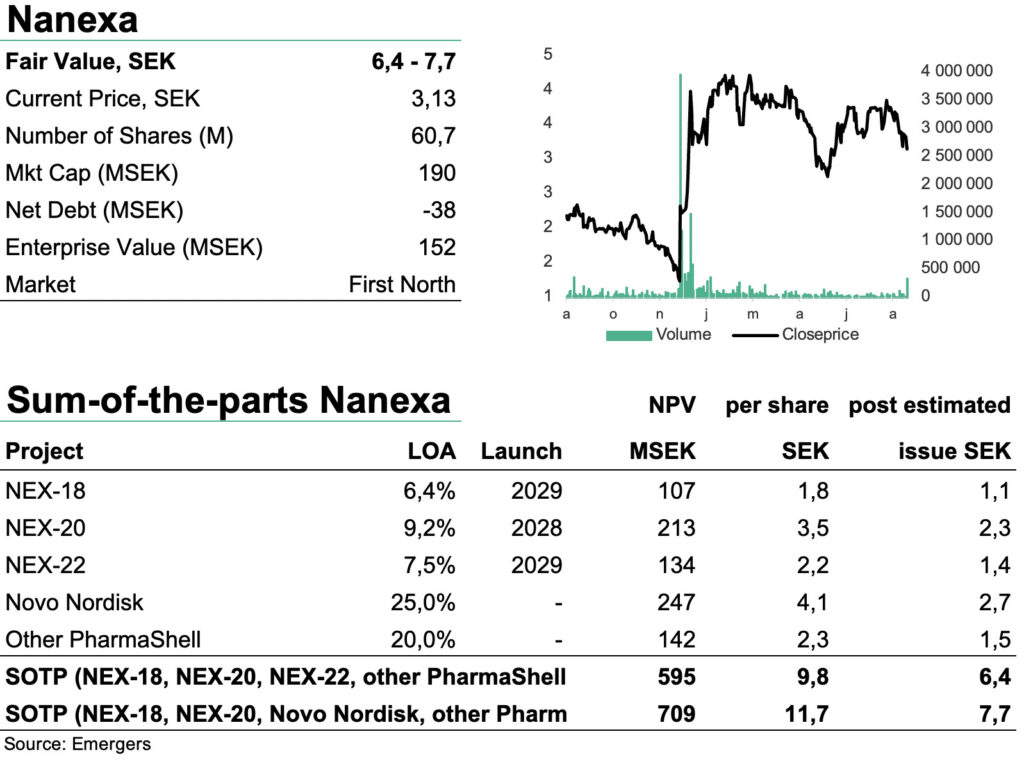

Nanexa’s Q2’23 advancements with NEX-20 and NEX-22 underscore the company’s forward momentum. NEX-20 is set to provide a more detailed release in October, while NEX-22 has shown promising results in minipigs, consistent with earlier rat studies. The rising general interest for the GLP-1 sector emphasizes the potential in Nanexa’s partnership with Novo Nordisk. However, with cash just enough for the rest of the year, we expect a raise later in H2’23. Our updated rNPV model, taking a raise of another year’s runway into account, supports a fair value of SEK 6.4-7.7 (6.6-7.2) per share, with further upside as the company continues to de-risk the portfolio with progress in clinical development.

Johan Widmark | 2023-08-24 08:00

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

Solid progress with NEX-20 and NEX-22 in Q2’23

For NEX-20 (a long-acting injectable of lenalidomide for treatment of multiple myeloma), Nanexa just released initial positive PK data from the healthy volunteers, showing a controlled release of lenalidomide. Now, Nanexa expects the full PK profile, safety and tolerability data in October. The company’s primary focus in Q2’23 however, was on NEX-22 with a new study on minipigs confirming a long release profile of liraglutide. This conformed earlier studies in rats, with a controlled release of liraglutide for 28 days, compared to 2 days for a formulation without the PharmaShell coating. Now Nanexa expects to submit the clinical trial application later in H2’23 with initiation of phase I in early 2024 (a slight postponement compared to our earlier estimated timeline) for which it has signed the renowned CRO Profil.

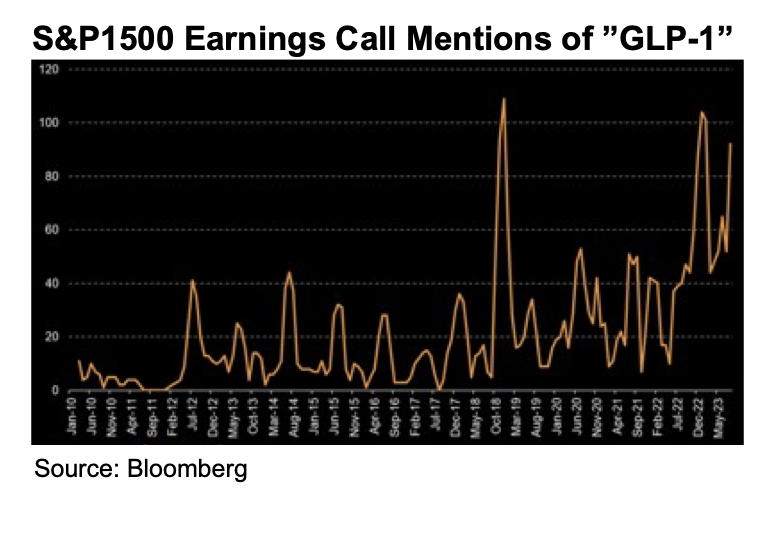

GLP-1 angle heating up

Surprisingly, the Nanexa share has not benefitted from the recent surge in interest in GLP-1. According to Bloomberg data, references to “GLP-1” in earnings call transcripts this quarter have more than doubled since the same period a year ago, driven by these drugs’ capacity for weight loss, in addition to diabetes treatment. This newfound interest in GLP-1 has also caused share prices of Novo Nordisk and Eli Lilly to soar. NEX-22 is a long-acting depot formulation of GLP-1 agonist liraglutide. Liraglutide is currently available as a once-daily injection, but NEX-22 is designed to be injected once a month, meaning a significant improvement in convenience for patients, and adherence.

This is also positive for Nanexa’s evaluation agreement with Novo Nordisk. While the primary target for that collaboration has not been specified, it could likely be other GLP-1 Semaglutide, now accounting for over 1/3 of Novo Nordisk’s revenues, with very positive growth prospects. In Q2’23, 45% of Novo Nordisk’s revenues were for some GLP-1 drug.

In light of recent development, we have raised our assessment of the probability for a future license deal with Novo Nordisk from 20% to 30%, while lowered the royalty assumption from 5% to 3%. As the target application drug is still not specified, our NPV model makes a rough assumption of an application of PharmaShell on 10% to Novo Nordisk’s portfolio long term. This corresponds to an rNPV of SEK 4.1 per share. However, should PharmaShell be applied to all GLP-1 drugs in Novo’s portfolio, the potential rNPV impact would be 4-5x that. But all estimates with regards to Novo’s potential application of PharmaShell, pricing strategy and customer segmentation are highly uncertain.

Eventful 12 months ahead

Revenue in Q2’23 amounted to SEK 7.7m, driven by periodization of the prepaid fee from Novo Nordisk and other evaluation agreements for PharmaShell. With OPEX at SEK 27m the cash position of SEK 38.4m gives the Company runway to the end of 2023, but not much more. This highlights the need to secure additional funding, most likely in the form of a rights issue. But with a strategic industry giant such as Novo Nordisk as Nanexa’s largest shareholder, chances to secure continued financing should be good.

With the progress in pre-clinical trials with NEX-22, the forthcoming completion of phase I with NEX-20, updates to our estimates for the evaluation agreement with Novo Nordisk, and an estimated rights issue of SEK 80m at an estimated 25% discount, we now find support for a fair value of SEK 6.4-7.7 (6.6-7.2) per share. After the results of phase I with NEX-20 later in H2’23, we look forward to initiation of Phase I with NEX-22 and NEX-18 (long-acting injectable azacitidine for myelodysplastic syndrome) in 2024.

DISCLAIMER