Johan Widmark | 2025-07-03 08:00

Financing secured to deliver on milestones

Prolight has announced that all 501.5 million shares offered in the rights issue were subscribed, with approximately 70% taken up by existing shareholders exercising their rights and the remaining 30% subscribed without rights. The rights issue raised approximately SEK 100 million before transaction costs and was completed without underwriters, highlighting strong interest in the company’s long-term potential. With this funding in place, Prolight can now proceed to optimise the system design, validate the pilot production lines and build inventory ahead of a European market launch.

Strong insider and partner commitment

A notable aspect of the outcome was the significant participation by the board, management and employees, who together invested approximately SEK 10 million, alongside ITL, Prolight’s contract manufacturing partner, committing an additional SEK 9.9 million. This combined commitment reinforces credibility and signals strong alignment of interests with shareholders. It also supports a robust negotiation position as the company advances discussions with potential commercial partners in H2 2025.

Valuation and outlook unchanged

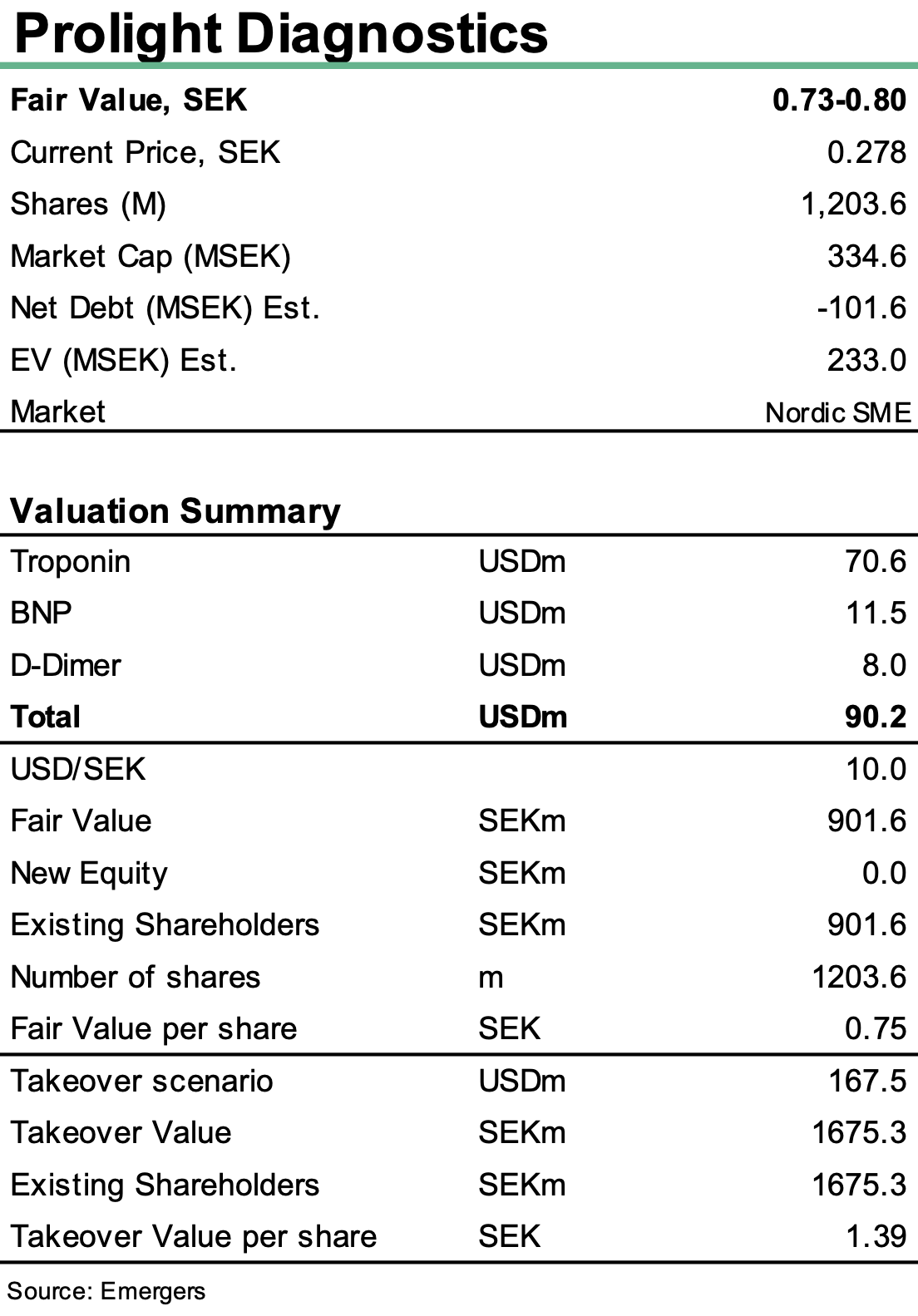

Given the fully subscribed issue, our previous fair value range of SEK 0.73–0.80 per share remains intact, with an upside scenario of SEK 1.35 (USD 160m) supported by read-across from the recent SpinChip transaction. The successful financing further reduces execution risk, and we expect Prolight to intensify business development activities over the coming quarters as the final design freeze and clinical study preparations progress.