Johan Widmark | 2024-02-05 08:00

A game changer in the immune analysis field

After acquiring Psyros Diagnostics in 2022, Prolight is advancing the development of a single molecule counting (digital) immuno analysis device that enables detection of biomarkers at extremely low concentrations, using a single drop of blood. In Sweden, 250,000 patients seek medical attention for chest pains annually, of which less than 10% are ultimately diagnosed with heart attacks. Current diagnostic methods result in long waiting times, but Prolight’s device provides results in 10 minutes, reducing financial burden and patient suffering. While this technique integrates the possibility of simultaneous testing of multiple biomarkers (multiplexing), Prolight is initially focusing on tests for the cardiac biomarker, troponin.

Significant market potential for POCT

Prolight has significant growth potential not only in the USD 1.5 billion troponin testing market but also in other valuable biomarkers such as B-type natriuretic peptide (BNP) for suspected heart failure and D-Dimer for suspected blood clot formation, a market valued at USD 1.2 billion. Additionally, there are opportunities to expand their point-of-care technology into other areas like Neuropathology, Immune System Dysfunction such as sepsis, and Virus Detection, representing multi-billion-dollar markets. Considering the immense long-term potential of Prolight’s technology, we have focused our valuation approach primarily on the troponin biomarker while also considering BNP and D-Dimer as potential additional verticals.

Expect commercial launch in partner setup by 2026

Following the proof-of-performance announced in mid-June, followed by whole blood in November 2023, Prolight now focuses on the development of the commercial instrument prototype for digital immune analysis, in partnership with Integrated Technologies Limited (ITL) and the preparations for the IVDR certification. This is expected to take 24 months, due to the shortage of Notified Bodies, which is why the Company predicts commercialization of the troponin test by early 2026, followed by BNP in 2028 and D-Dimer in 2030. This roadmap is however highly uncertain.

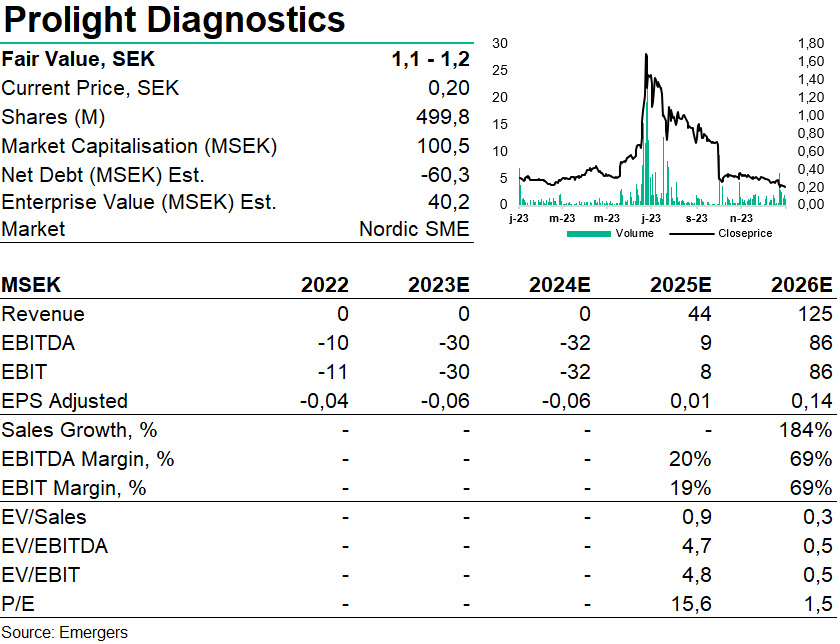

Using an estimated price of USD 20 per troponin POC-test, an annual suspected heart attack incidence rate of 2.5%, peak market penetration of 30% by 2034 (10m tests) would translate to sales of SEK 2.4bn. Through many possible rollout scenarios, we expect Prolight to rollout together with a commercial partner and receive a total of USD 20m of upfront payments, and a 15% royalty on future sales, at an estimated 75% cumulative probability to reach commercialization. Adding the potential for BNP and D-Dimer POC-tests at 12.5% royalty, this translates to a NPV of SEK 680m. Following the rights issue in December 2023 (76% subscription) this motivates a fair value of SEK 1.1-1.2 per share, factoring in additional new equity of a total of around SEK 100m. Should Prolight manage to raise the max amount in TO6 + TO7 at SEK 169m the surplus could be used to expand the scope and accelerate timeline.

DISCLAIMER