Johan Widmark | 2024-08-30 09:00

Tailwind for in-store marketing

Order intake in Q2 saw a slight pullback to SEK 2.8m, down from SEK 4.4m a year ago, with most orders arriving toward the end of the quarter. With an order backlog at SEK 2.2m (compared to SEK 4.2m), this suggests that investors should prepare for a slightly softer Q3. However, the global retail index has shown strong performance, up 27% year-to-date, indicating favorable conditions for in-store marketing investments. Collaborations with global procurement organizations, which serve as key gateway partners to the company’s customers, should also help diversify revenues and drive growth going forward. Overall, we expect any softness in H2 to be short-lived.

Further upside in the cards

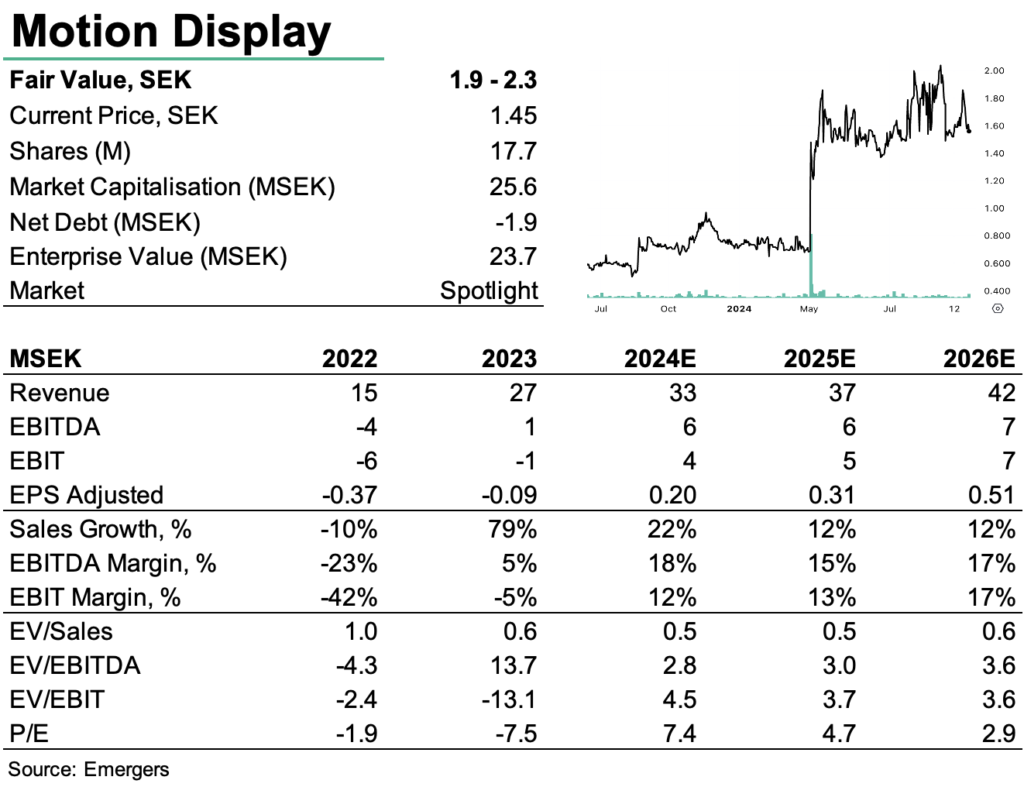

Liquidity remains a concern for the company, as the build-up of components, coupled with long payment terms from customers and advance payments to suppliers, strains cash flow. With cash now at SEK 3.5m, a rights issue is not our primary expectation for the next 12 months. We maintain our forecast of SEK 33m in sales for 2024e and a 12% annual growth rate thereafter. With a long-term gross margin target of 50%, which might be somewhat conservative, and a discount rate (WACC) of 23%, our combined DCF and target multiple valuation (1x sales ‘24) support a fair value range of SEK 1.9-2.3 per share, suggesting the share still has upside potential.

DISCLAIMER