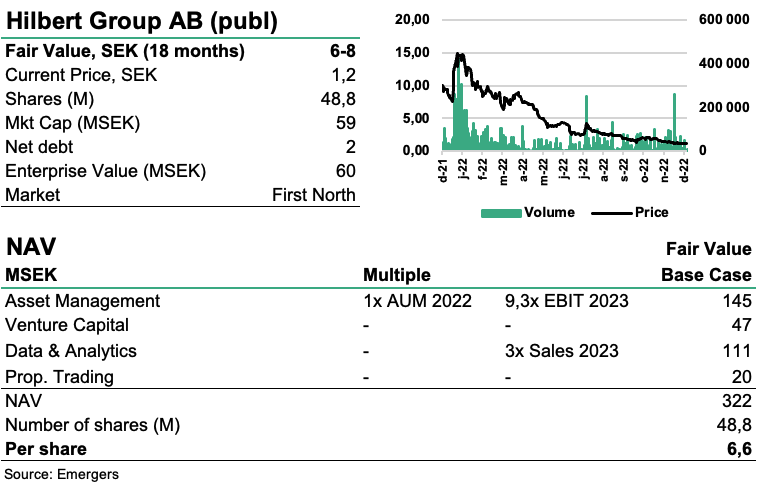

HILBERT GROUP Despite a challenging crypto landscape, with the FTX collapse creating ripple effects throughout the crypto ecosystem, Hilbert Group is progressing as planned. While reported numbers in Q3’22 failed to impress, Hilbert’s multi-vertical setup makes it well positioned to capitalize on a stabilization of the crypto space in 2023 and we now find support for a fair value of SEK 6–8 per share (14–17) in 12-18 months.

Andreas Eriksson | 2022-12-08 08:00

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

Building a solid foundation in stormy surroundings

In an already negative sentiment, the crash in FTX and the upcoming trial of its founder Sam Bankman-Fried, adds to the insecurities plaguing the crypto market. FTX and also of LUNA crashing earlier in 2022 have highlighted that “traditional financial regulations” might be necessary also in the blockchain/crypto space, or at least for the centralized exchanges. While these collapses have nothing to do with blockchain or digital assets and is more the result of lacking governance and sometimes even fraudulent behavior, these events affect all crypto businesses across the board.Coin360 already one of the biggest in the space

Despite the negative sentiment, Hilbert Group has continued to build a solid organization to stand ready when the markets turn. Hilbert has added well-renowned names such as Richard Murray as CEO of the asset management division. Murray brings extensive experience from Finisterre Capital and Brevan Howard, one of the world’s leading macro hedge funds, and Hilbert currently has discussions with over 100 financial institutions about investments in Hilbert’s funds. The company’s first equity investment, in the website Coin360 is also a bright spot, as it has contributed SEK 5,7m in revenues so far in 2022, mainly from ads. The next step is to launch a Data & Analytics service, with a retail and a premium version to cater to the three million unique page visitors every month. Also, crypto investment bank HAYVN (Hilbert’s second equity investment), has managed to grow their number of employees over the year from 14 to 43 today, onboarded over 1000 KYC approved customers while growing revenue 6x year-on-year.Ready to capitalize when the bull market returns

In our view, the key figure to watch for long-term shareholder value in Hilbert Group is the assets under management (AUM). While the SEK 97m in AUM reported in Q3’22 is lower than what we estimated in the beginning of the year, this is also a reflection of the fact that Bitcoin, and most altcoins with it, are down some 75% from the top in November 2021. With lower than projected AUM, and subsequent lower projected earnings from fees, we have now lowered our estimated EBIT in 2023 from SEK 63m to SEK 16m. With an assumption of total AUM of SEK 130m by the end of 2022, capital inflow from several institutions and the Bitcoin price up 50% in 2023, we now find support for a fair value of SEK 6 – 8 per share (SEK 14 – 17) in 12-18 months.DISCLAIMER